Hey there, fellow finance nerds! 👋

The Finance Engineer here, and today we're talking about one of the simplest and most important forms of investing for beginners and experienced investors alike. That's right, we're discussing ETFs – or Exchange Traded Funds – and how they can be a fantastic way for young adults in the U.S. with little to no experience in finance to start building a solid investment portfolio. So get ready, and let's dive into the world of ETFs! 👇

🥤ETFs: The Investment Smoothie

Think of ETFs as the investment equivalent of a fruit smoothie. Instead of buying individual fruits (stocks) separately, you purchase a ready-made blend that contains a mix of all the best flavors. This means that, with a single investment, you're getting a diversified portfolio of stocks or bonds, reducing your risk and making your life a whole lot easier because we like being lazy.

For new investors, understanding and tracking the market can be overwhelming. That's where ETFs come in! ETFs allow you to 'buy the market', giving exposure to hundreds, sometimes thousands, of stocks or bonds in one go. Simplicity at its best! 🌐💹

❓ETFs vs. Mutual Funds: The Battle of the Blends

You might be wondering how ETFs differ from mutual funds, another popular investment "blend." While both offer diversification, there are a few key differences that make ETFs a particularly attractive option for newbie investors:

1. Trading flexibility: ETFs are traded like stocks, meaning you can buy and sell them throughout the trading day, whereas mutual funds are bought and sold at the end of the day at their net asset value (NAV).

2. Lower fees: ETFs generally have lower expense ratios than mutual funds, which means more of your hard-earned cash stays in your pocket.

3. Tax efficiency: Due to their structure, ETFs are often more tax-efficient than mutual funds, making them a smart choice for investors looking to minimize Uncle Sam's cut.

Overwhelmed? Don’t stress too much over choosing between an index ETF or Index mutual fund, what’s more important is starting!

💰Getting Started with ETFs: A Recipe for Success

Ready to enter into the realm of ETF investing? Here's an uncomplicated guide to kickstart your journey:

Define your foundation: Select the type of ETFs that align with your investment objectives and risk tolerance. The options are diverse – stock ETFs, bond ETFs, commodity ETFs, and even unique ETFs concentrating on specific industries or themes.

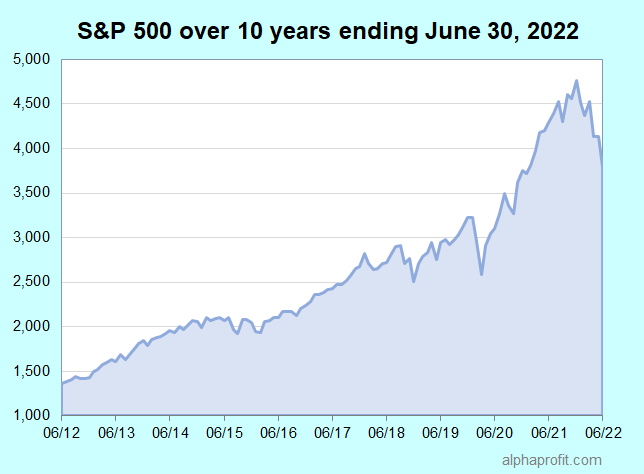

Integrate cost-effective alternatives: Seek out ETFs with low expense ratios to ensure more of your capital is actively invested. A sensible point of departure is ETFs that trace widely-recognized indices, such as the S&P 500, as they usually have lower costs.

Adopt a patient approach: ETF investing is a long-term endeavor. Exercise patience and let the power of compounding play its role.

🥳 Final Thoughts: Cheers to Your Financial Future

ETFs present a straightforward, comprehensible investment avenue, especially for young adults making their first foray into finance. They provide diversification, lower fees, and tax efficiency – all vital components for a successful investment portfolio. As Always, the best time to invest was yesterday and the 2nd best time is today.